Shop Eligible Products

Dream Weighted Sleep Sack - Palm Leaf

Dream Weighted Transition Swaddle

How to Purchase with HSA / FSA

Better sleep, smarter savings

FAQs

Are your products FSA/HSA eligible?

Yes! We have partnered with Flex to facilitate HSA / FSA payments. Only our Weighted Sleepwear Collection is eligible for HSA / FSA payment upon verification. Select HSA / FSA as your payment method at checkout. Please see here for more details.

What is an FSA or HSA, and how do they help?

An FSA (Flexible Spending Account) lets you use pre-tax dollars from your paycheck for medical expenses like copays, prescriptions, and health products. FSAs are set up through your employer and usually follow a “use-it-or-lose-it” rule, meaning funds must be used within the plan year.

An HSA (Health Savings Account) is available if you have a high-deductible health plan. Like an FSA, it uses pre-tax dollars for healthcare costs—but with more flexibility. Your HSA balance rolls over year to year and stays with you even if you change jobs.

Both options can help you save on healthcare and stretch your dollars further.

What is a Letter of Medical Necessity? (LOMN)

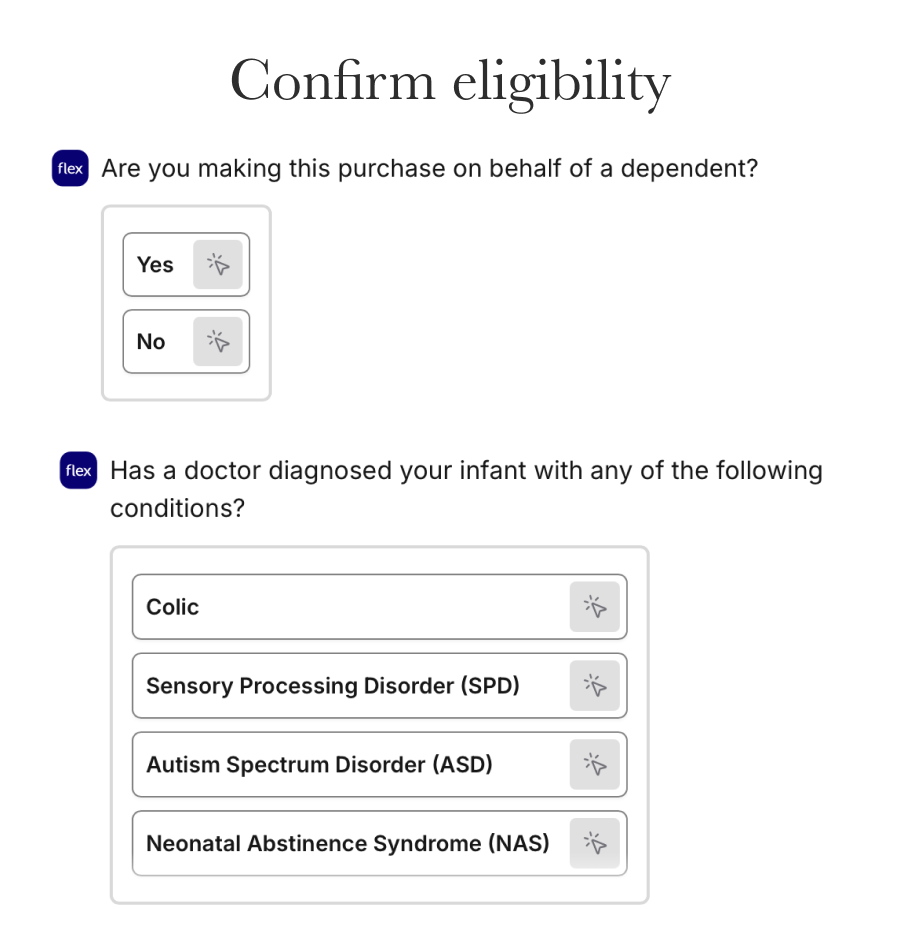

A letter is essentially a note from a doctor stating that you are purchasing an item to treat or manage a medical condition. More details can be found here.

I'm not seeing HSA or FSA options show up at checkout.

This means that the product is not eligible for this payment method.

Why was my HSA or FSA card rejected?

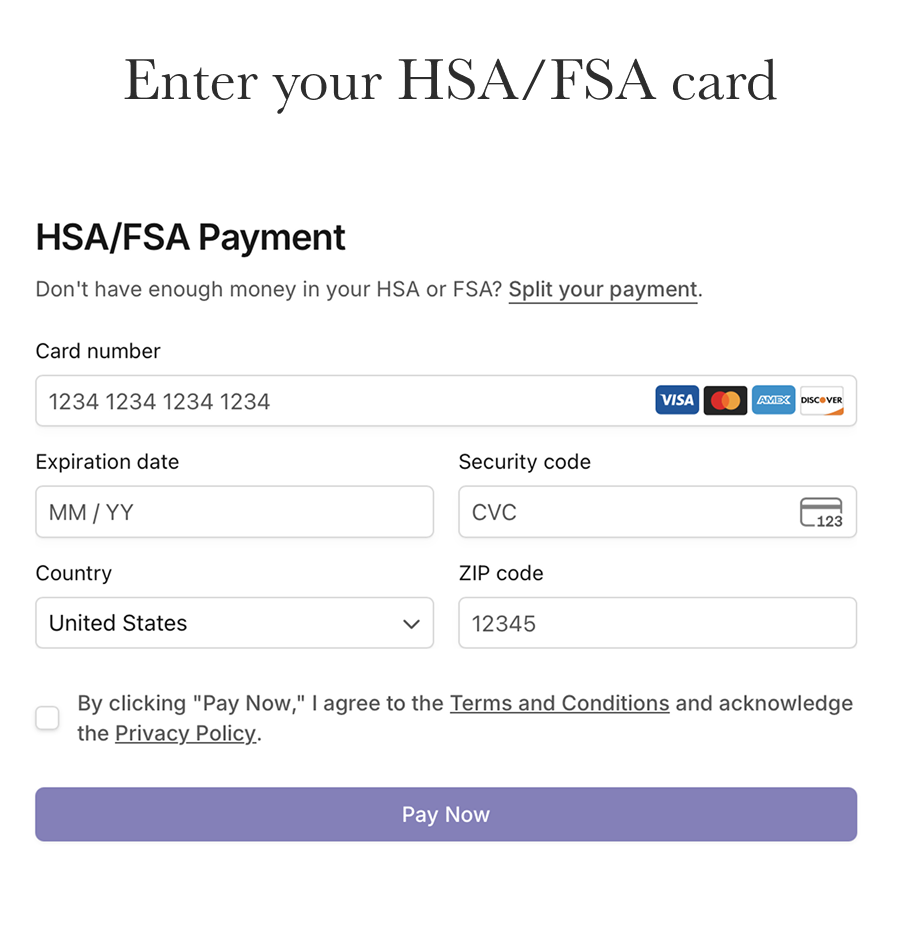

Like any credit or debit card, HSAs/FSAs can be declined if any of the card data is incorrect, such as the number, expiration date, or zip code. Flex will notify you at checkout if any of these fields are missing or inaccurate, allowing you to update them. The most common reason for card rejection is insufficient funds. Contact your HSA or FSA provider to check the amount in your account before trying to complete your purchase again.

Why do I need to provide Dreamland with health information?

To qualify to use your HSA or FSA card for Dreamland Baby HSA/FSA eligible products, the IRS requires you to have a Letter of Medical Necessity. We have partnered with Flex to offer asynchronous telehealth visits during checkout. Within 24 hours of your purchase, Flex will email you an itemized statement receipt.

Do I need to do anything with my Letter of Medical Necessity?

It's recommended to retain your Letter of Medical Necessity for a minimum of three years. This is important in case of an IRS audit of your HSA or FSA account. Additionally, your FSA provider may request this letter to verify the eligibility of your purchase.

I accidentally entered my name and/or date of birth and need to get a corrected letter. Who should I contact?

Please email [email protected], and they will coordinate with their telehealth team to reprocess and send your updated Letter of Medical Necessity.

I did not receive an itemized receipt or a Letter of Medical Necessity from Flex. What should I do?

Please check your spam folder, as emails from [email protected] may sometimes be automatically filtered as spam by some email providers. If you still can’t find it, please email [email protected] and provide the email address linked to your order.

What is Flex, and how is it related to Dreamland Baby?

We have partnered with Flex to let you use your Health Savings Account (HSA) or Flexible Spending Account (FSA). This means eligible customers can now use their HSA or FSA debit card to purchase Dreamland products with pre-tax dollars, saving 30-40% depending on your tax bracket.

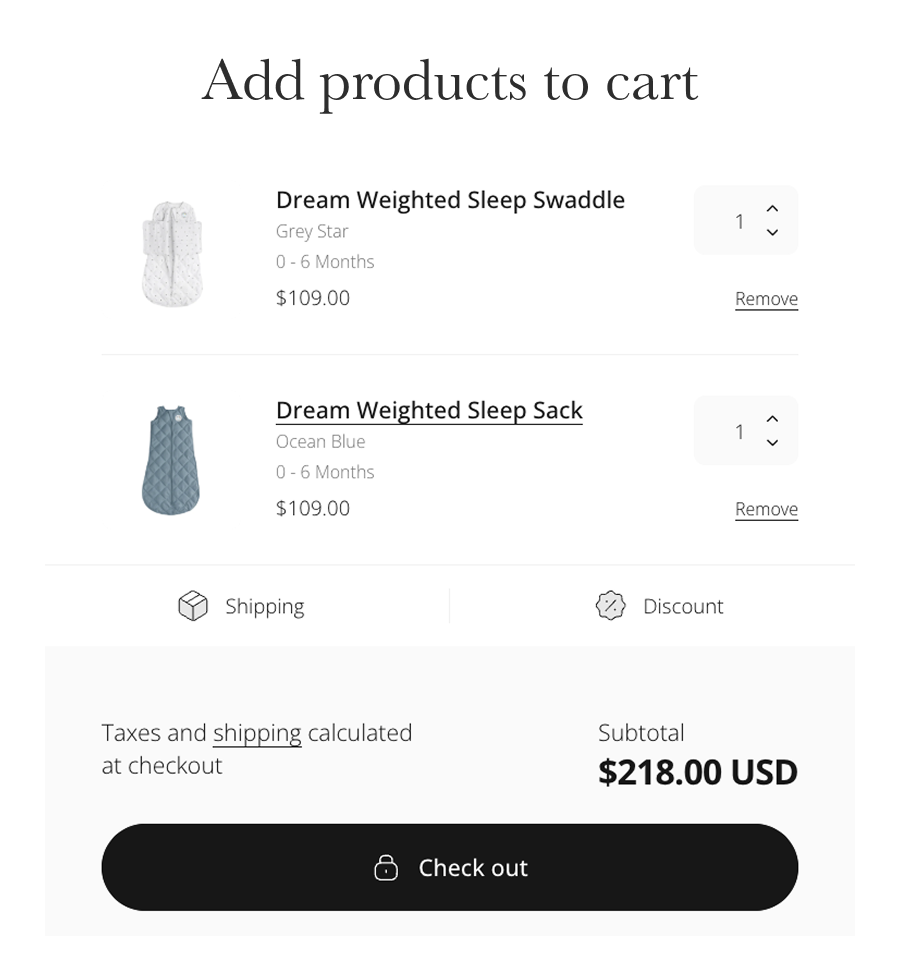

How do I pay with my HSA or FSA card?

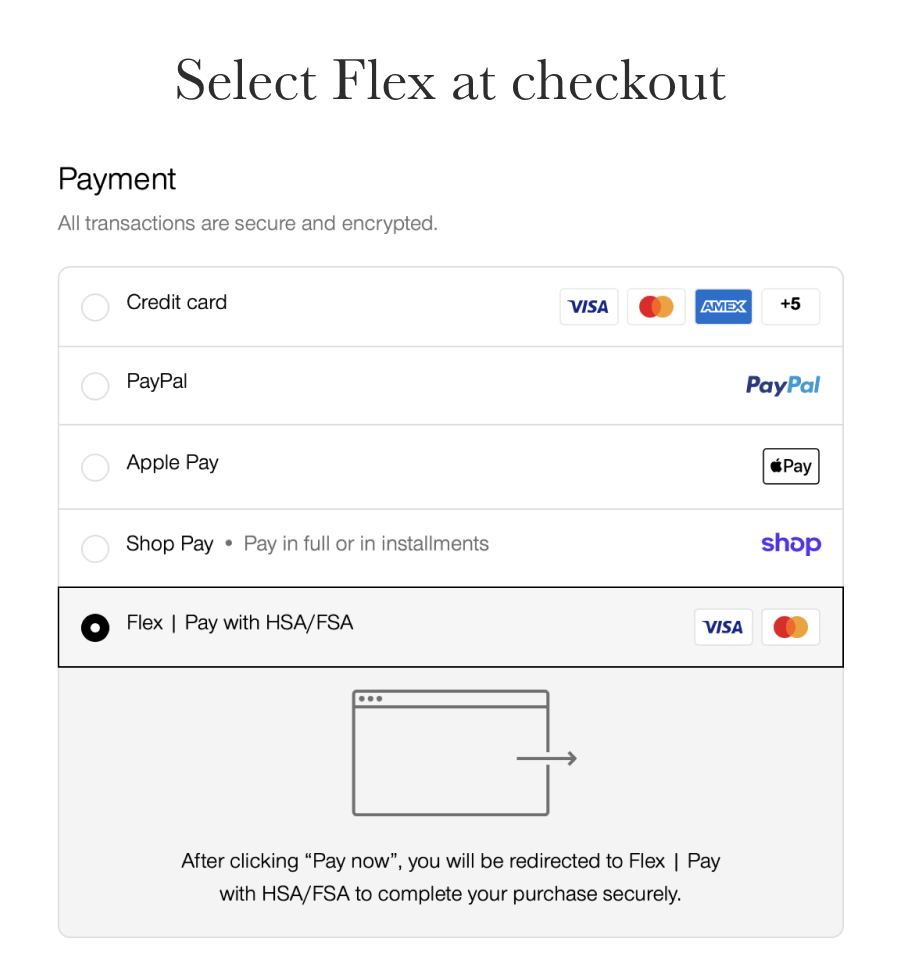

To use your HSA or FSA debit card, add items to your cart as usual. During checkout, choose “Flex | Pay with HSA/FSA” as your payment option, enter your HSA or FSA debit card details, and finish your checkout as usual. If you don’t see “Flex | Pay with HSA/FSA,” you might be in Shop Pay. Select “checkout as guest” to see more payment options.

What if I don’t have my HSA / FSA card with me?

If you don’t have your HSA or FSA card available, still select “Flex | Pay with HSA / FSA” as your payment method. Enter your credit card details, and Flex will email you an itemized receipt for reimbursement.

Why can’t I see Flex as a payment option?

The key is to ensure you're logged out of ShopPay. One of the simplest ways to do this is to complete checkout in an incognito window.

Why is my HSA / FSA card being declined?

The most common reason for a decline is insufficient funds, as HSA / FSA cards are debit cards. Please contact your HSA / FSA administrator to verify your balance.

I didn’t receive an email from Flex with my itemized receipt and/or letter of medical necessity. What should I do?

Check your spam folder, since emails from [email protected] can sometimes be filtered as spam by some email providers. If you still don’t see it, please email [email protected] and provide the email address linked to your order.

I want to use multiple HSA / FSA cards to pay for an item. Can I do that?

No, unfortunately, this feature is not supported right now. If there aren't enough funds in a single HSA or FSA account, you can enter a credit card on the Flex checkout page instead. You will receive an itemized receipt and/or Letter of Medical Necessity from Flex, which you can submit for reimbursement.

Do HSA / FSA funds cover sales tax, or is it treated separately?

HSA / FSA funds also cover sales tax for eligible items. If the customer has a split cart, the tax will be divided among the cards based on the items.